Expense receipts drivers#

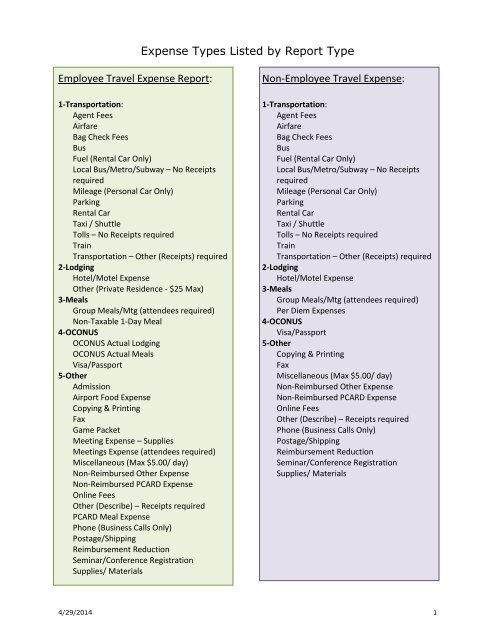

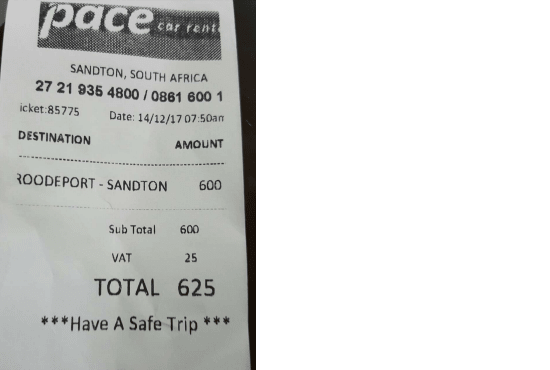

Tax Court for a review, asking it to allow a variety of vehicle expenses as well as the cash payments made to other drivers as tax deductions. Unicorn companies are booming, despite the pandemic's economic effects.Small businesses are spending more on digital marketing this year.Elon Musk and Bill Gates agree that memory is essential to entrepreneurial success.Microsoft Excel is one of the most vital tools for financial services and accounting.The court initially allowed a deduction for the Uber fees and the electronic transfers to other drivers, which left about US$240,000 in gross income to be taxed. On the taxpayer’s 2015 tax return, he reported only wage income of US$19,000 but when he was audited by the IRS, it reassessed him for the entire US$542,000 of unreported income. If a taxpayer in court can demonstrate through credible oral testimony that a payment was made or an expense incurred, the court must make a finding based on that evidence and give effect to it.” In allowing the taxpayer to claim a business investment loss notwithstanding that the taxpayer didn’t have the supporting loan documentation, the Tax Court of Canada judge wrote, “Whatever may be the policy of the CRA to require documentation to support an expense, a payment or a deduction, it is not the policy of this court, unless the taxing statute specifically requires it (as for example, in the case of charitable donations). This was expanded upon nearly a decade later in a case involving a taxpayer who lost money on a loan but had no documentation supporting the loan. For example, the Supreme Court of Canada ruled in a 1997 case that “where the (Tax Act) does not (explicitly) require supporting documentation, credible oral evidence from a taxpayer is sufficient notwithstanding the absence of records.” The courts, however, have been somewhat more forgiving when it comes to the ability to deduct expenses without having the corresponding receipts. Under the heading “Auditing expenses claimed without supporting vouchers,” the CRA’s auditors are told that if expenses are not supported with the appropriate documents, “disallow the expense unless there is other satisfactory audit evidence to support the amount claimed.” The CRA audit manualĪs taxpayers, we can glean further insight into the importance of providing evidence to justify our expenses from the CRA’s Income Tax Audit Manual, which is given to CRA auditors, but is also available online.

Nonetheless, the CRA went on to say that, in the absence of a receipt for an expense that a taxpayer is attempting to claim on their return, “it is open to you to substantiate that you paid for that service.” For example, a copy of the invoice for services rendered together with a cancelled cheque in lieu of a receipt, or an itemized monthly bank statement showing that the invoice was paid, would suffice.

The CRA responded that while there is no legislation that requires a business to provide a receipt to acknowledge payment for services rendered, the Income Tax Act says that a taxpayer must keep adequate books and records “in such form and containing such information, as will enable tax payable to be determined.”

This advertisement has not loaded yet, but your article continues below.

0 kommentar(er)

0 kommentar(er)